It’s a popular scene from TV and movies. Our hero works long hours at their first job. Then, when payday arrives, the number on the check doesn’t match what they expected. “What?!? Who is this FICA? Why’s he getting all my money?” they say.

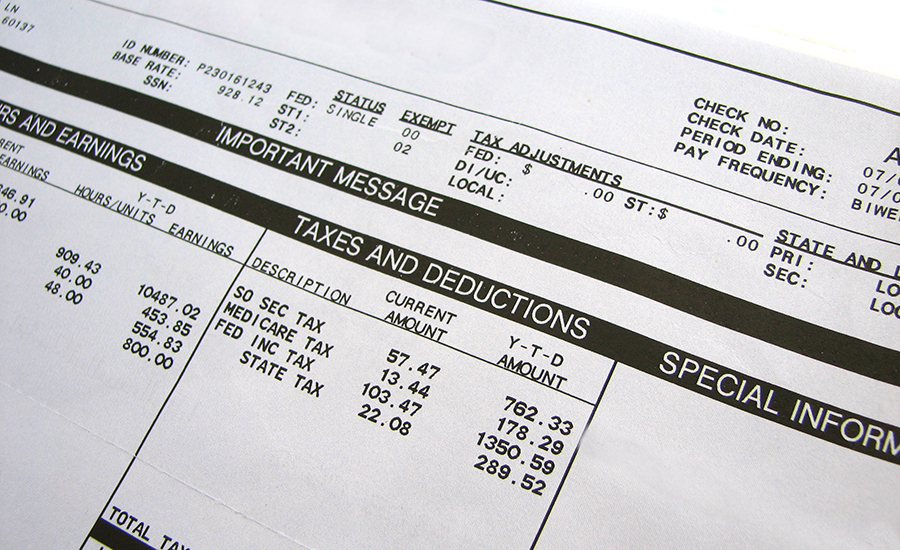

It can be jarring at first—and you may never get used to it—but your paycheck is more than just your take-home pay. It’s a snapshot of your earnings, taxes, benefits, and deductions—all packed into a few confusing lines. But in most cases, your pay stub consists of three main sections: your pay rate, your tax deductions, and any other deductions.

Gross Pay vs. Take-Home Pay

Your gross pay (also referred to as total or pre-tax pay) is your total earnings before any deductions are taken out. Depending on your job, gross pay may include your hourly wages or salary, overtime pay, bonuses or commissions, and holiday or paid time off hours.

Your take-home pay (also called net pay) is what actually lands in your account after taxes, insurance, retirement contributions, and other deductions are subtracted. And, despite the popular TV trope, the gap between the two isn’t money mysteriously vanishing. It reflects the real cost of the taxes, benefits, and protections paid out of each check. When you’re budgeting or planning monthly expenses, it’s your take-home pay—not your gross pay—that matters most.

Federal and Oregon State Taxes

For most people, taxes account for the biggest difference between gross pay and take-home pay. Federal income tax is withheld from each paycheck to cover what you owe in taxes over the course of the year. While it can feel frustrating, this pay-as-you-go approach is generally easier than making one large payment at tax time. The amount withheld from each check depends on factors like your income, filing status, and the information you provided on your W-4 form.

If you live and work in Oregon, you’ll also see Oregon state income tax withheld from your paycheck. Like federal withholding, this amount is based on your earnings and filing details. Not every state collects income tax, but Oregon does.

Together, federal and state taxes can add up, but they help fund infrastructure, public services, and state and national programs—and either way, you owe them. If too little is withheld, you could owe money at tax time. If too much is withheld, you may receive a refund.

Social Security and Medicare (FICA)

In addition to income taxes, your paycheck typically includes deductions for Social Security and Medicare, often grouped together as Federal Insurance Contributions Act (FICA) taxes. These are federal programs that help fund retirement benefits, disability income, and health care for older adults and certain individuals with disabilities. And, while these deductions reduce your take-home pay now, they’re designed to support you and others later in life.

Unlike income tax, FICA deductions are calculated as fixed percentages of your earnings, so they come out of every paycheck regardless of your tax bracket. Your employer also pays into your Social Security and Medicare, but you won’t see that listed on your pay stub.

Pre-Tax and Post-Tax Deductions

In addition to taxes, many paychecks include other deductions for benefits or programs you’ve signed up for. Some of these are pre-tax deductions, meaning they are deducted before your taxes are calculated. Common examples include health insurance premiums, retirement contributions, and health savings (HSA) or flexible spending (FSA) accounts. Because these deductions lower the amount of your pay that gets taxed, they can slightly reduce how much you owe in taxes.

Other deductions are post-tax deductions, which are taken out after taxes have already been applied. These may include Roth retirement contributions, union dues, garnishments, or other optional benefits. Post-tax deductions don’t lower your tax bill, but they still reduce your take-home pay.

Why this matters: Pre-tax deductions let you pay for things like health insurance or retirement savings with money that hasn’t been taxed yet. That can lower the amount of income you’re taxed on and help stretch your dollars a little further. Choosing pre-tax options is one way to make benefits and long-term savings more affordable without having to find extra money elsewhere in your budget.

Why It’s Worth Reading Your Pay Stub—Yes, Every Time

Even if you use direct deposit and never see a paper check, it’s smart to regularly check your pay stub. It shows exactly how your pay is calculated, what’s being taken out, and where your money is going before it reaches your account. Ignoring it could mean overpaying (or underpaying) on taxes or missing out on potential benefits.

Checking your pay stub can also help you catch payroll errors and confirm that your benefits and contributions are being applied correctly. A quick scan each payday is usually enough to make sure your hours, pay rate, and deductions look right, especially after changes like a new job, a raise, or updated benefits. Regular checks also give you a clearer sense of how much of your income is actually available to spend, save, or use for monthly expenses.