Money hasn’t always looked like the coins and paper we use today, but it has been a part of human civilization for over 10,000 years (as far as we know). Long before credit cards and coins, people found clever ways to trade goods for services. So, in honor of Youth Savings Month, we’re exploring how the history of money has shaped society and the people we are today.

The Origins of Money

Human history relied for generations on communal living. However, the establishment of nation-states inspired a need for the exchange of goods and services between otherwise disconnected groups. These earliest forms of trade relied on systems of bartering. For instance, imagine you had a basket full of apples, and you wanted to get a new blanket. You might offer your apples to a weaver in exchange for a new woven blanket. Barter systems like this worked, but they had limitations. For example, what if the weaver in our example didn’t like apples? You might have to offer something of more value or risk missing out on a warm blanket.

To simplify things, ancient civilizations began to use special items (like cattle, grain, salt, animal skins, shells, gold, and silver) as commodities with an agreed-upon value. These commodities became early forms of money. Their usefulness, perceived value, and widespread acceptance made them ideal for facilitating trade.

The Emergence of Coinage

The invention of coins (or coinage) marked a significant milestone in the history of money. Many believe that the first standardized coins were created over 2,000 years ago in Lydia, (which is now Turkey). These Lydian Lion coins were typically made from electrum—a naturally occurring alloy of gold and silver—and bore stamped markings of a lion’s head (the symbol of the Lydian king). They also featured a punch mark to indicate their value and authenticity.

The adoption of coins revolutionized trade by providing a more convenient and universally accepted medium of exchange. Coins also facilitated the rise of market economies and enabled the growth of long-distance trade networks across ancient civilizations such as Greece, Rome, and China.

The Age of Paper Money

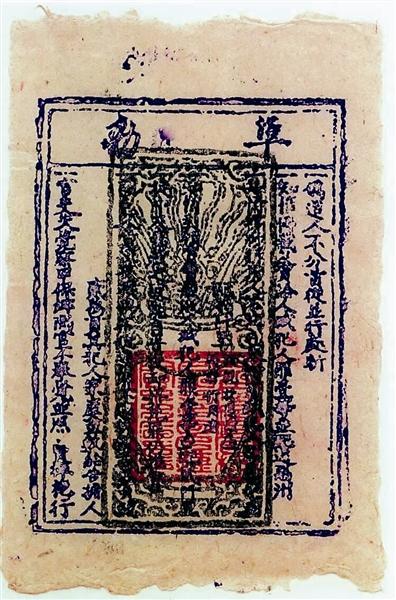

While coins remained the primary form of currency for centuries, the need for something more portable and convenient led to the development of paper money. The earliest known use of paper money dates back to China during the Tang Dynasty (618-907 CE). Merchants and traders in China began using promissory notes and certificates of deposit as a more convenient alternative to carrying bulky coins.

However, it was during the Song Dynasty (960-1279 CE) that paper money became more widespread and official. It is widely believed that the Chinese government issued the world’s first fiat currency, which is a form of currency backed by the state’s authority rather than intrinsic value like gold or silver. This innovation laid the foundation for modern paper currency and paved the way for its adoption in other parts of the world. Since the mid-20th century, most countries have adopted fiat currencies, allowing central banks to control the money supply and implement monetary policies to manage inflation, interest rates, and economic stability.

The Rise of Banking and Financial Institutions

The development of banking institutions further transformed the nature of money and finance. In medieval Europe, early banking practices emerged, including money lending, currency exchange, and the issuance of promissory notes. Italian city-states like Florence and Venice became centers of banking and trade, facilitating economic growth and cultural exchange throughout Europe.

Then, in the 15th century, Italian mathematician Luca Pacioli (who is sometimes dubbed “The Father of Accounting”) formalized double-entry bookkeeping. This revolutionized accounting practices and enabled banks to manage increasingly complex financial transactions. Nearly 200 years later, the establishment of central banks (such as the Bank of England in 1694) provided stability to national economies and laid the groundwork for modern monetary policy.

The Gold Standard and Fiat Currency

During much of the 19th and early 20th centuries, many countries adhered to the gold standard, directly linking the value of their currency to a specific amount of gold. Under this system, governments guaranteed to redeem their currency for gold upon demand, providing stability and confidence in the monetary system.

However, the gold standard began to unravel during the 20th century, particularly after World War I, as countries struggled to maintain sufficient gold reserves to support their currencies. The Great Depression further strained the gold standard, leading many countries to abandon it in favor of fiat currency backed by the state’s authority.

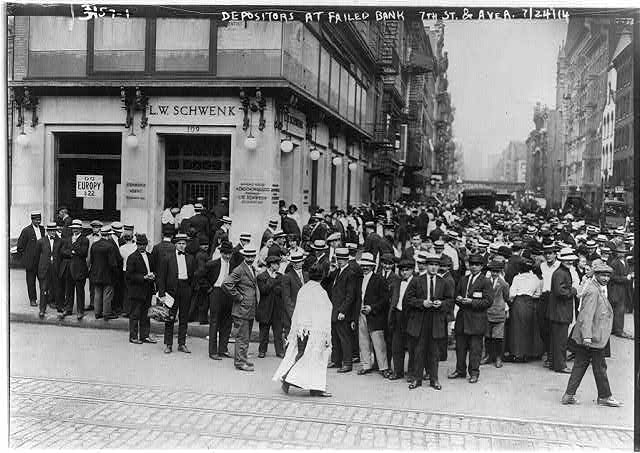

The Credit Union Movement

The steep economic downturn of the Great Depression fueled what became known as “The Credit Union Movement—but that wasn’t the first appearance of the concept. Friedrich Wilhelm Raiffeisen, who aimed to help farmers and workers access affordable loans, founded the first credit union in Germany in the 1850s. He believed that if members pooled their resources, they could better survive the ever-changing economic environment. In the early 20th century, North American credit unions followed suit by launching small community-based financial cooperatives in Canada and the United States. In the midst of the Great Depression (and following a wave of bank failures), the principle of people helping people resonated deeply for those experiencing hard times.

Believe it or not, the Maps Credit Union you know today started on the ground floor of that movement. On June 6, 1935, just one year after the Federal Credit Union Act became law, 20 teachers convened an organizational meeting at what was then known as Salem Senior High School. That day, they agreed to volunteer their time and talents to start a credit union that would benefit the employees of Marion County Public Schools and Willamette University. Today, the credit union movement thrives through member-owned institutions prioritizing community and financial literacy over profit.

The Digital Revolution and Cryptocurrency

The advent of the internet and digital technology ushered in a new era of money and finance. Now, advanced technology, such as blockchain, artificial intelligence, and digital payments, are reshaping how we interact with money.

Take, for example, Bitcoin and Ethereum. These cryptocurrencies use advanced technology called blockchain to secure transactions and create new forms of money.

What makes blockchain so unique is that once information is recorded in a block, it’s very hard to change it. And, blockchain technology is useful for a lot of things—like keeping track of transactions in cryptocurrencies (like Bitcoin and Ethereum) and establishing ownership of digital assets, such as NFTs. Additionally, blockchain can serve non-currency functions like securely storing medical records or tracking a supply chain of goods from the factory to the store.

No single government or institution controls cryptocurrencies in the same manner as they control fiat currency. Instead, these currencies rely on cryptographic principles to secure transactions and verify the integrity of the network. For better or worse, proponents feel the decentralized nature of cryptocurrencies offers transparency and security, while also challenging traditional notions of money and financial regulation. Of course, the FDIC and NCUA do not protect cryptocurrency transactions and exchanges against default, insolvency, or bankruptcy. Additionally, those open, decentralized networks carry heightened risks, such as a lack of regulation and insufficient oversight across the industry.

The Digital Horizon

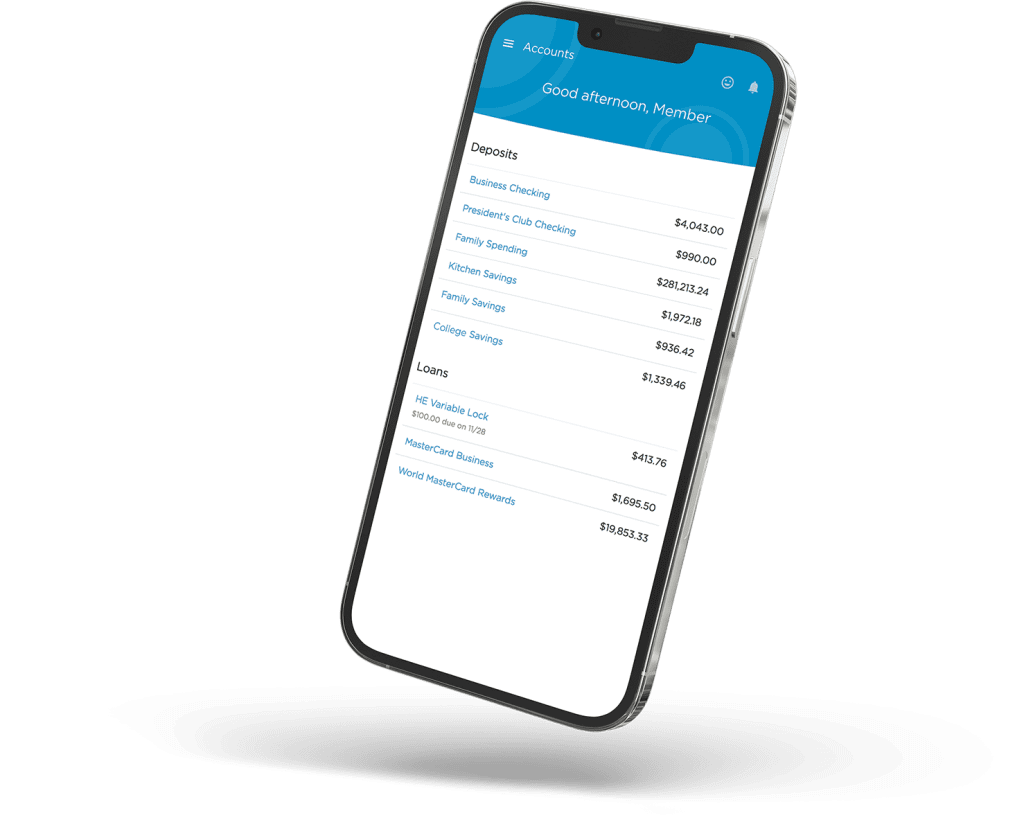

Digital currencies and the internet offer new possibilities for fast and secure transactions—especially in our increasingly interconnected world. Over the years, the widespread use of smartphones and computers has changed the world of mobile and online banking. Now, people overwhelmingly choose to manage their finances digitally.

And why not? Mobile banking apps allow customers to check their balances, transfer money, and even apply for loans from the convenience of their smartphones. This trend towards digital banking is making financial services more accessible and convenient for people worldwide, especially in regions with limited traditional banking infrastructure.

The Future of Money

As we look to the future, the evolution of money shows no signs of slowing down. Our economic history is a testament to humanity’s ingenuity and adaptability—particularly in shaping economic systems and trade. From humble beginnings as primitive forms of barter to the emergence of sophisticated digital currencies, money has played a central role in facilitating trade, fostering economic growth, and shaping the course of human history. As we stand on the cusp of a new era of financial innovation, who knows what the future holds?

Currently, developers are creating innovative financial technologies to assist underserved communities in accessing banking services and engaging in the global economy. There is also a growing awareness about the environmental impact of traditional banking practices, which has led to a push for more sustainable banking solutions. In the coming years, perhaps we’ll see continued advancements and a greater emphasis on making banking more inclusive and environmentally friendly.