How to Safeguard Yourself in the Digital Age

In an age dominated by technology, scams have become increasingly sophisticated—but there are common denominators to watch out for. To shield yourself from harm, get to know these 10 commonly reported scams.

1. Phishing Scams: The Art of Deception

Phishing, vishing, or smishing scams are deceptive messages via phone, email, or text that appear to be from a trustworthy source, such as your bank, credit union, or a government agency. The key thing to watch out for is that these emails almost always contain urgent requests for personal information or prompt you to click on malicious links. Before clicking anything, verify the legitimacy of the sender (and always think twice before sharing any sensitive information).

2. Online Shopping Scams: Too Good to Be True? Probably Is.

Everyone loves a good deal. But now more than ever, it’s wise to be wary of offers that seem too good to be true. Scammers create fake websites or use ads to lure victims into making purchases for products that either don’t exist or are cheap knockoffs. To protect yourself, always shop with reputable online retailers and read reviews before making a purchase. For added protection, use a credit card. You are more likely to get your money back if something goes awry.

3. Tech Support Scams: Unwanted Assistance

Tech support scams involve fraudsters claiming to be from a reputable tech company. They tell you that your computer has a virus or security issue and often request remote access to your device to fix nonexistent problems. In some cases, they will even demand payment for their “services”. Legitimate tech companies will not contact you unsolicited. If you get such calls or messages, hang up or ignore them.

4. Romance Scams: Matters of the Heart and the Wallet

Romance scams often start on dating websites or social media platforms. Scammers build trust and emotional connections with their victims before inventing a crisis that requires financial assistance. Be cautious when developing online relationships and never send money to someone you haven’t met in person.

5. Impersonation Scams: Familiar Faces, False Intentions

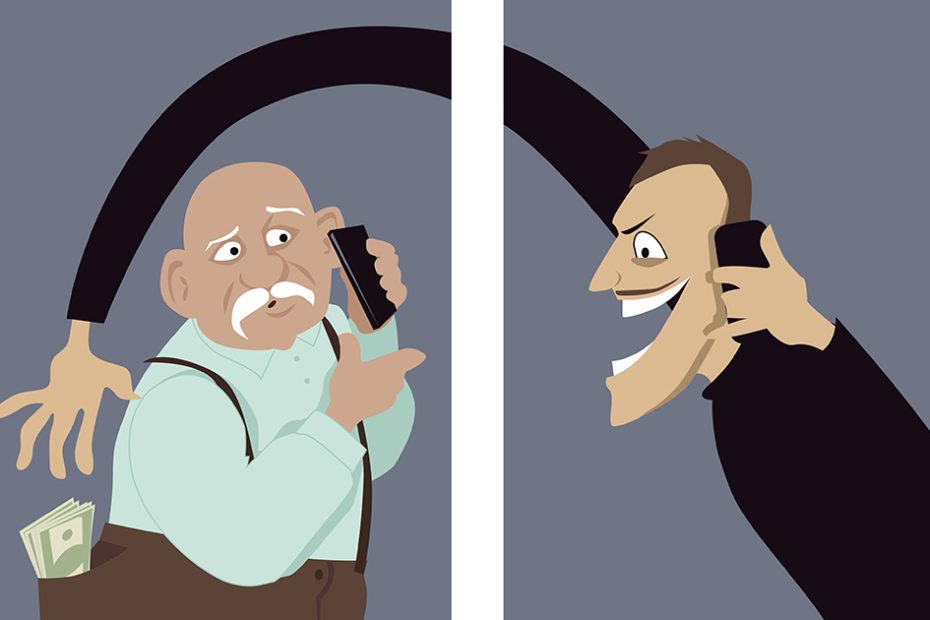

Impersonation scams involve criminals posing as someone you know or trust, such as a relative, friend, or even a government official. They may claim an emergency (like an accident or arrest) and request funds urgently. To avoid getting caught in this scam, always verify the identity of the person contacting you, especially if they’re seeking financial assistance.

6. Lottery or Prize Scams: You Didn’t Win, But They Did.

If you receive a message claiming you’ve won a lottery or prize but need to pay fees upfront, it’s likely a scam. Legitimate lotteries and contests do not require payment to claim winnings. Be skeptical of unexpected notifications declaring you as a lucky winner.

7. Grandparent Scams: Exploiting Love and Trust

In grandparent scams, fraudsters pose as grandchildren in distress, seeking urgent financial help. If you get a distressing call from a grandchild (or other family member) always confirm the caller’s identity. Scammers tend to exploit emotions to elicit quick financial assistance.

8. IRS Impersonation: Tax Troubles That Aren’t Real

It’s tax season and that means it’s IRS scam season. IRS impersonation scams involve fake calls or emails claiming outstanding tax payments or legal action. The IRS does not initiate contact through unsolicited calls or emails. If in doubt, verify directly with the IRS using official contact information.

9. Social Security Scams: Threats to Benefits

Scammers may impersonate Social Security officials, threatening to suspend benefits unless immediate action is taken. Official government agencies do not make such threats over the phone. Hang up and report any suspicious calls to the Social Security Administration.

10. Investment Scams: Too Good to Be True Returns

Be cautious of investment opportunities promising exceptionally high returns with little risk. Scammers may pressure you to make quick decisions without proper information. Before investing, conduct thorough research and consult with a financial advisor.

The best defense against these common scams is to stay vigilant and informed. Be cautious with unsolicited communications, double-check the legitimacy of online platforms, and trust your instincts. If something feels off, take the time to verify things before taking any action.

If you believe you have already been scammed, act immediately. Contact your financial institution and notify your creditors. Set up fraud with credit reporting bureaus and balance alerts in your online banking platform to notify you of any fraudulent activity. If necessary, file a report with local law enforcement and the FTC. Finally, if you fear your personal information has been compromised, consider freezing your credit to prevent scammers from opening new accounts in your name.